Stripe is widely used by online sellers, SaaS founders, and small businesses because it’s easy to integrate and works well across countries. However, many sellers misunderstand how Stripe pricing actually works. The headline rate looks simple, but the Stripe fee structure includes multiple layers that affect real profit.

This is where problems usually start. Sellers often:

-

Price products based only on Stripe’s base fee

-

Ignore fixed fees on small transactions

-

Overlook international, currency conversion, and refund-related costs

The result is lower margins than expected—even when sales look strong.

In this guide, Stripe fee structure explained with examples, you’ll learn exactly how Stripe charges fees, how those fees show up in real transactions, and how to calculate true costs before listing products or launching subscriptions.

Before diving into examples, it helps to understand how Stripe fees work at a high level across different transaction types.

Table of Contents

ToggleHow Stripe’s Fee Structure Works

Stripe charges fees per successful transaction. These fees vary based on location, payment method, and transaction type.

At a high level, Stripe fees fall into five main categories:

-

Standard transaction fees

-

Fixed per-transaction fees

-

International card fees

-

Currency conversion fees

-

Refund and dispute-related fees

Let’s break each one down clearly.

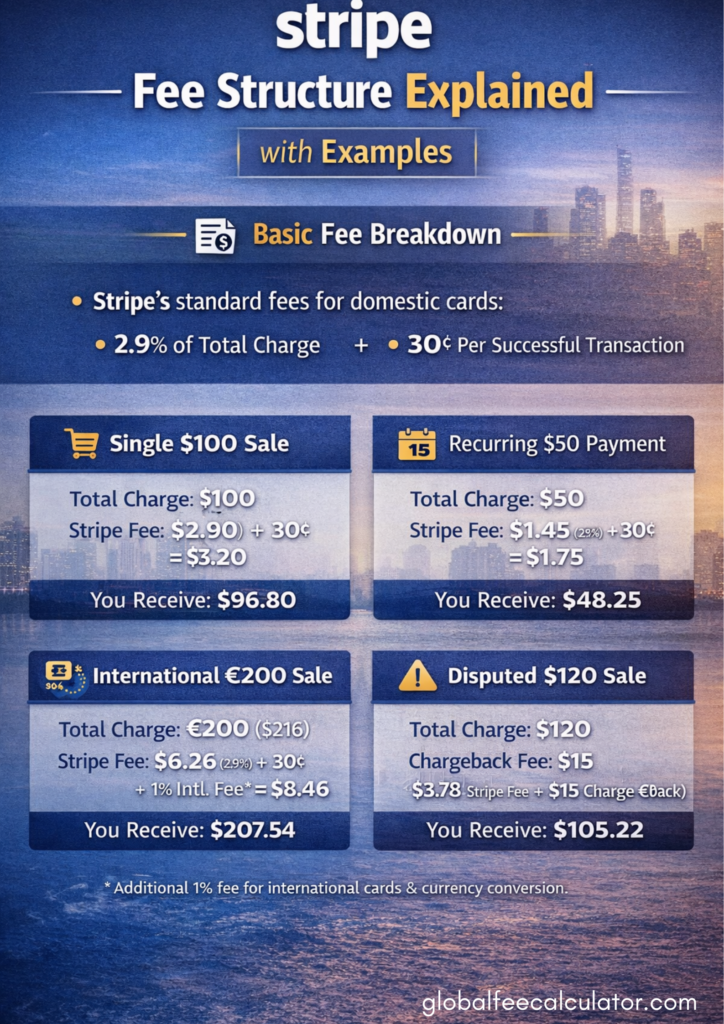

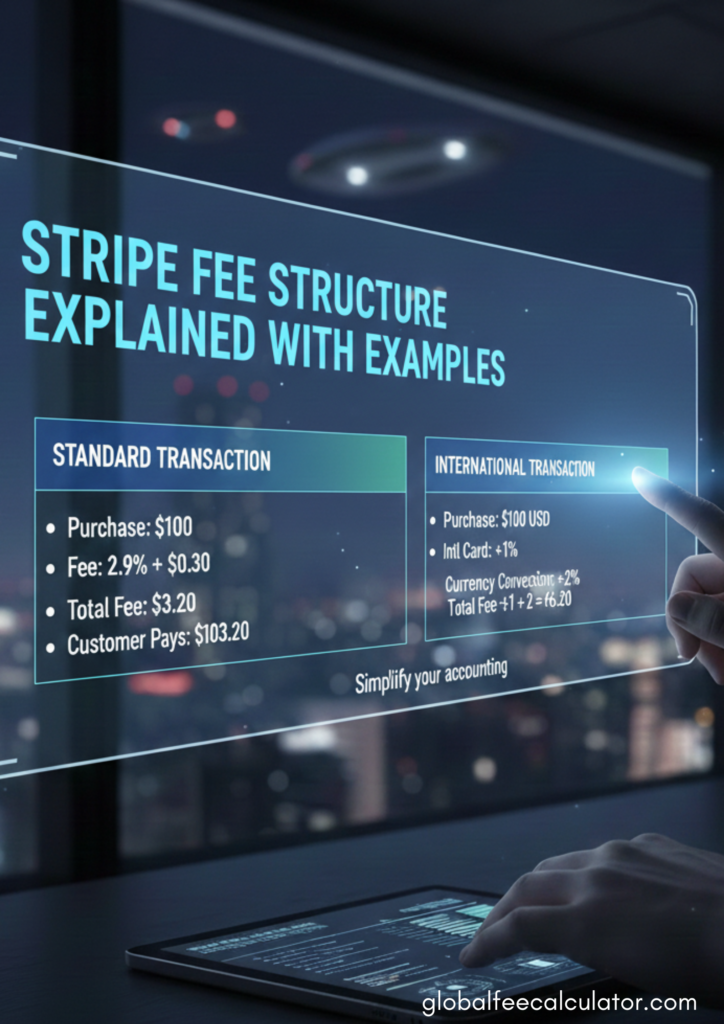

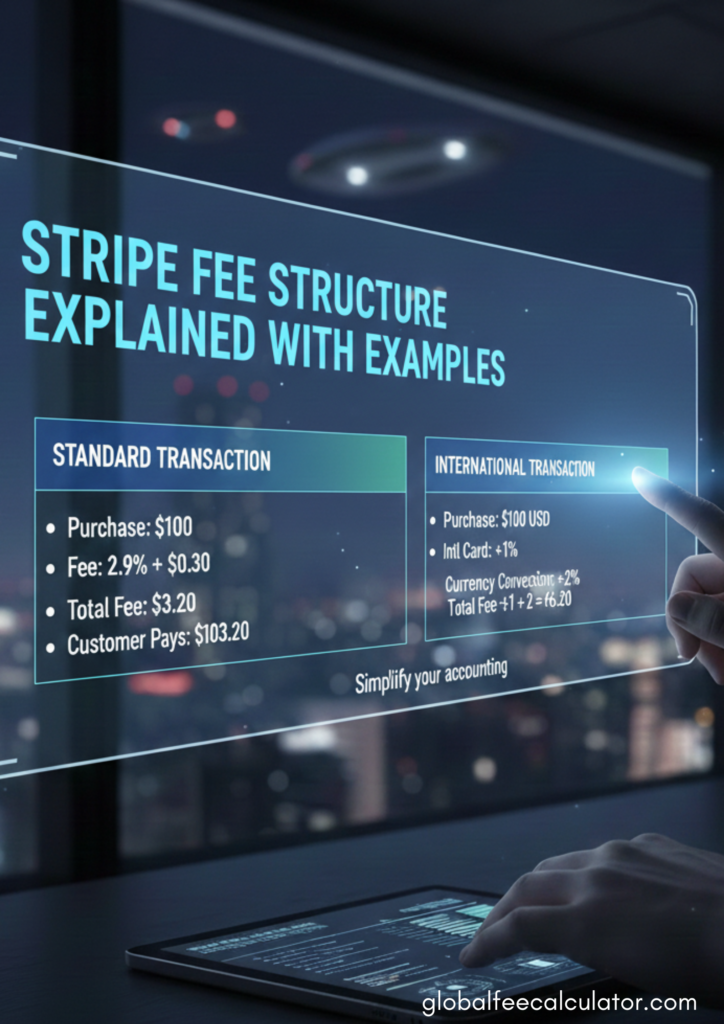

Standard Stripe Transaction Fees

Percentage-Based Fee

Stripe charges a percentage of the transaction value. This applies to every successful card payment.

Example:

Sale amount: $100

Percentage fee: 2.9%

Percentage cost: $2.90

Fixed Fee Per Transaction

In addition to the percentage, Stripe charges a flat fee per transaction.

Example:

Fixed fee: $0.30

This fee applies regardless of transaction size

Combined Example

If you sell a product for $100:

Percentage fee: $2.90

Fixed fee: $0.30

Total Stripe fee: $3.20

Net received before other costs: $96.80

This is the basic calculation most sellers stop at—but it’s rarely the full picture.

While examples are useful, using a tool to calculate Stripe fees accurately helps businesses model costs based on their own transaction values and currencies.

How Fixed Fees Affect Small Transactions

Fixed fees have a much larger impact on low-priced products.

Example: Small Transaction

-

Sale amount: $5

-

Percentage fee (2.9%): $0.15

-

Fixed fee: $0.30

-

Total fee: $0.45

That’s 9% of the sale, not 2.9%.

This is why sellers of digital downloads, templates, or low-cost items often struggle with margins unless pricing is adjusted carefully.

After reviewing these examples, many businesses naturally wonder if Stripe fees can be reduced in real-world scenarios.

Stripe Fees for International Payments

Stripe applies additional fees when payments cross borders.

International Card Fee Explained

If a customer uses a card issued outside your business’s country, Stripe adds an international card fee.

Example:

-

Sale amount: $100

-

Standard fee: $3.20

-

International card fee (example): $1.00

-

Total Stripe fee: $4.20

This fee applies even if the customer pays in your currency.

Currency Conversion Fees with Examples

Currency conversion fees apply when the customer pays in one currency and your Stripe account settles in another.

Example: Currency Conversion

-

Customer pays €100

-

Stripe converts to USD

-

Conversion fee applied (percentage-based)

-

Exchange rate margin included

Even if the conversion cost seems small per transaction, it adds up over time—especially for global sellers.

If you sell across borders, these examples should be considered alongside Stripe international fees, which can change total costs significantly.

Stripe Fees for Refunds

Refunds are another commonly misunderstood area.

What Happens During a Refund

When you issue a refund:

-

The customer gets their full payment back

-

Stripe usually keeps the fixed fee

-

Conversion fees are not returned

Refund Example

-

Original sale: $50

-

Stripe fee paid: $1.75

-

Refund issued: $50 returned to customer

-

Fee refunded: $0.00 (fixed fee lost)

Frequent refunds increase your effective fee rate even if sales volume stays the same..

Chargebacks and Dispute Fees

Chargebacks involve additional costs beyond the original transaction.

Chargeback Example

-

Sale amount: $75

-

Original Stripe fee: $2.48

-

Dispute fee: flat charge per case

-

If you lose: you lose the product + fees

Even winning disputes involves time and administrative cost, which indirectly affects profitability.

Subscription and Recurring Payment Fees

For SaaS founders and membership businesses, Stripe fees apply to every recurring charge.

Subscription Example

-

Monthly subscription: $20

-

Stripe fee per charge: $0.88

-

Annual Stripe fees per user: $10.56

Multiply this by hundreds or thousands of subscribers, and small differences matter.

Failed payment retries can also generate costs through repeated processing attempts.

Practical, Legal Ways to Manage Stripe Fees

Stripe fees are unavoidable, but they can be managed responsibly.

Price With Fees Included

Instead of absorbing fees unknowingly:

-

Calculate average Stripe fees

-

Price products based on net revenue goals

This ensures every sale contributes to profit.

Increase Average Order Value

Higher transaction values reduce the impact of fixed fees. Consider:

-

Bundled products

-

Annual plans instead of monthly

-

Minimum order thresholds

Reduce Refunds and Disputes

Operational clarity helps:

-

Accurate product descriptions

-

Clear refund policies

-

Responsive customer support

Lower refunds mean fewer lost fees.

Choose Settlement Currency Carefully

If most customers pay in one currency:

-

Set that as your settlement currency when possible

-

Avoid unnecessary conversions

This simplifies accounting and lowers costs.

Common Stripe Fee Mistakes to Avoid

Calculating Fees After Pricing

Fees should be considered before setting prices, not after profits shrink.

Assuming All Transactions Cost the Same

Domestic, international, and converted payments all have different costs.

Ignoring Fixed Fees During Discounts

Discounts reduce revenue but fixed fees stay constant, sometimes turning sales unprofitable.

Guessing Instead of Calculating

Estimations often miss edge cases like refunds or international cards

Beyond standard calculations, businesses should also watch for hidden Stripe fees that may not appear in basic pricing examples.

Recommended Tools to Reduce These Fees

Managing Stripe fees effectively requires visibility, not shortcuts. Neutral tools designed for sellers help by:

-

Calculating total Stripe fees per transaction

-

Factoring in international and conversion costs

-

Modeling refunds and pricing scenarios

Fee calculators make it easier to understand real margins and make informed decisions without changing payment providers or violating policies.

Final Summary

Stripe’s pricing model is transparent—but only if you understand every component. The Stripe fee structure explained with examples shows that real costs go beyond the headline rate.

Key takeaways:

-

Stripe fees include percentage and fixed components

-

Small transactions are heavily impacted by fixed fees

-

International and conversion costs reduce payouts

-

Refunds and disputes increase effective fees

Sellers who calculate fees accurately price smarter, protect margins, and grow sustainably. Informed decisions—not assumptions—are what keep online businesses profitable over time.

Frequently Asked Questions (FAQs)

1. Is Stripe’s fee always 2.9% + $0.30?

No. That’s the base fee. International, conversion, and dispute fees may apply.

2. Why are small Stripe transactions expensive?

Because the fixed fee represents a larger percentage of low-value sales.

3. Does Stripe charge extra for international customers?

Yes. International card fees and conversion fees often apply.

4. Are Stripe fees refunded when I issue a refund?

Usually, the fixed fee is not refunded.

5. Do subscriptions cost more on Stripe?

Each recurring charge has the same fee structure, which adds up over time.

6. Are currency conversion fees avoidable?

Only if charge and settlement currencies are the same.

7. Can Stripe fees change over time?

Yes. Pricing updates and regional differences may apply.

8. How often should sellers review Stripe fees?

Regularly, especially when expanding internationally or changing pricing.

9. Are Stripe fees negotiable?

Typically only for very high-volume businesses.

10. Why does my payout look lower than expected?

Stripe fees, refunds, conversion costs, and disputes usually explain the difference.

Recommendation:

Always verify details directly on the official company website before making any business or financial decision.